Gold prices have declined from their intraday high of $2,470 following the release of robust US Retail Sales data for July. This data has influenced market expectations, impacting both the precious metal and broader economic outlook.

On Thursday’s North American session, the gold price (XAU/USD) retreated from its peak near $2,470. The drop in gold prices comes as the US Census Bureau reported a stronger-than-expected rise in Retail Sales for July, which expanded by 1%. This figure surpassed the anticipated increase of 0.3%, reflecting solid consumer spending and inflationary pressures. In contrast, retail sales had contracted by 0.2% in June, revised downward from an initial flat performance.

The unexpectedly strong Retail Sales data has shifted market sentiment regarding the Federal Reserve’s future actions. Traders had widely anticipated that the Fed would start reducing interest rates from the September meeting, but the new data has tempered expectations for substantial rate cuts. While strong retail sales suggest a resilient consumer sector, they have also reinforced the notion that the Fed might adopt a more cautious approach to rate reductions.

The impact of the Retail Sales data was quickly reflected in the financial markets. The US Dollar (USD) and bond yields experienced a notable rebound. The US Dollar Index (DXY), which measures the Greenback’s strength against a basket of major currencies, surged nearly 0.5% above the critical resistance level of 103.00. Concurrently, the 10-year US Treasury yields jumped to approximately 3.94%. This rise in yields typically has a negative effect on non-yielding assets such as gold, as higher yields increase the opportunity cost of holding investments that do not generate income.

Additionally, initial jobless claims for the week ending August 9 were lower than anticipated, further strengthening the US Dollar and bond yields. First-time claims came in at 227,000, below the forecasted 235,000 and the previous figure of 234,000, which was revised up from 233,000. This lower-than-expected jobless claims data added to the perception of a strong labor market, further influencing the outlook for interest rates.

In the broader context of market movements, the gold price’s decline follows the release of the July US Consumer Price Index (CPI) report. This report, released on Wednesday, provided additional evidence that inflation is trending towards the Fed’s target rate of 2%. The annual headline inflation rate decreased to 2.9% from June’s 3% and expectations of 3%, while the core CPI, excluding food and energy prices, grew by 3.2%, in line with expectations but down from the previous 3.3%.

Despite the easing of year-on-year inflation pressures, the month-on-month data showed a 0.2% rise in both headline and core CPI, driven mainly by increased rental costs and transportation services. This uptick has dampened speculation for substantial rate cuts by the Fed.

According to the CME FedWatch tool, which tracks Federal Funds Futures pricing, traders now see a 25.5% chance of a 50 basis points (bps) reduction in interest rates in September, a significant decrease from the 55% probability observed a week earlier. Despite this shift, some Fed officials, such as Atlanta Fed Bank President Raphael Bostic, have expressed openness to a 50 bps rate cut if the labor market shows signs of weakening. In an interview with the Financial Times, Bostic highlighted the need for the Fed to be proactive in easing monetary policy to address potential economic challenges.

In summary, the gold price’s fall from its intraday high reflects a complex interplay of strong US economic data and evolving market expectations regarding Federal Reserve policies. The latest Retail Sales and CPI reports suggest a resilient economy, which may influence the Fed’s approach to interest rates and, consequently, the investment landscape for gold and other assets.

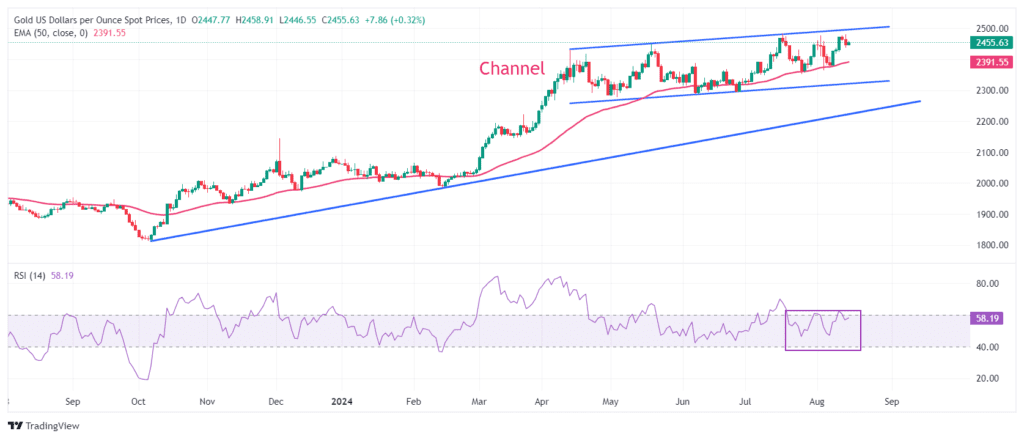

Technical Forecast: Gold Price Struggles to Reach All-Time Highs